If you look at the payroll and see the difference between gross and net salary, you often find your tax burden marginal. Nevertheless, other people still have to pay significantly larger parts of their salary to the tax authorities in most cases. In Germany, the tax rate is based on the amount of income. Legal framework requirements are also made in the process. A top tax rate applies in Germany. In the following article, we get to know about How much tax should I pay? So don’t skip the article from anywhere and read it carefully because it’s going to be very useful for you guys.

What is the top tax rate?

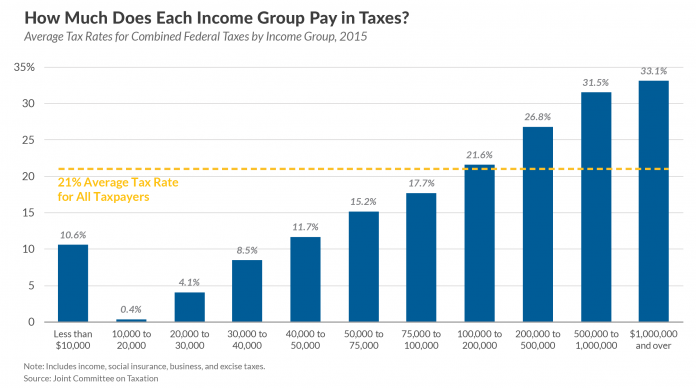

People with an above-average income often feel disadvantaged by the tax office because their tax burden is higher than other taxpayers tax should I pay. Around four million people in Germany have to pay the current top tax rate. But is the maximum tax rate unfair, or is it justified? In principle, the tax burden is calculated using a percentage tax rate. Each taxpayer is assigned an individual tax rate.

How high this tax rate depends on your income. The rule is: if you earn less, you also have to pay less tax. After the basic allowance has been exceeded, the lowest tax rate of 12 percent is applied. Based on this, the tax rate rises with the income until the top tax rate is reached. The maximum tax rate is called from a certain income. From this point on, payment can still increase, but the percentage taxation no longer applies tax should I pay. It is, therefore, the maximum possible tax rate. Even if the high tax share is always a topic of conversation: With the regulation of the top tax rate, the expected tax revenue remains precisely calculable, and the tax handling of income is transparent.

What is the top tax rate?

Sometimes it is said that a large part of the income is deducted from high earners. In reality, however, the top tax rate is less than half of the revenue. From an annual salary of 57,052, the top tax rate of 42 percent is applied. For couples assessed together, the top tax rate applies from a yearly income of 114,104 The maximum tax rate is below the 50 percent limit. People who have a very high income may contradict the statements made above.

It is possible in Germany to exceed the top tax rate by three percentage points. From an annual income of 207,501, the so-called wealthy tax is applied so, tax should I pay. By the way: Although it seems that the tax authorities are demanding more and more taxes, the top tax rates are falling. In 1980 the maximum tax rate was still 56 percent. Compared to today’s top tax rate, that’s a noticeable difference!

How is the tax rate calculated?

As already mentioned, the tax rate is based on income. However, the salary is not the only consideration here. Instead, any payment is aggregated and used as the basis for the tax rate. For example, income from rental income or commercial or freelance work is also taken into account tax should I pay. As you are probably aware, a wide variety of expenses can be deducted from income.

Allowances, business expenses, and certain expenses can reduce the taxable income and thus influence the tax rate. A good tax return can therefore be decisive in determining which tax rate will ultimately apply to you. So that you can make the most of your income and have to pay as little taxes as possible, you should rely on a qualified tax advisor when filing your tax return tax should I pay. Our team knows all relevant aspects and helps you to avoid mistakes.

Do German citizens have to pay the most taxes?

It is often claimed that the German state charges the most taxes in a global comparison. But is that true? Do German taxpayers have to pay that much more? If you look at taxation alone, Germany only ranks eighth worldwide and thus even behind the USA. However, as soon as you look at all of the taxes, including social security contributions, Germany slips into second place.

Only in Belgium do people have to pay more taxes. What sounds dramatic at first should be put in context. In Germany, comparatively high taxes have to be paid. However, the German citizen is also offered significantly more state benefits. If, for example, one compares the social benefits of the USA with Germany, it quickly becomes apparent.

Tax advice

So that your tax rate can be calculated correctly and you do not suffer any disadvantage, the annual tax return must be completed correctly. Unfortunately, in our everyday lives, we often experience that taxpayers make mistakes.

Resulting in tax disadvantages that often cannot be reversed. Therefore, you should seek professional advice at an early stage and have your tax return drawn up by a specialist.

Also read: how to shave your face